As a medical professional, you’ve dedicated countless hours to building your career and caring for others. Whether you’re a newly graduated doctor, dentist, or veterinarian, or an experienced professional, owning a home can feel like a distant goal. Student debt, limited credit history, and the high costs of buying a property add hurdles to achieving this milestone. Fortunately, the Doctor Loan program is here to change that.

Our Blog Puts YOU in the Driver’s Seat

Helping customers like you achieve their financial goals is all we do, which is why we’re arming you with our expert insight, tips, and advice to help you get there.

Mortgage Loans for Doctors: A Prescription for Homeownership

Doctor Loan: Expanded Access for Medical Professionals

Doctors, dentists, podiatrists, veterinarians, pharmacists, and CRNAs have some of the highest student loan balances and may have a difficult time qualifying for a mortgage when compared to other professionals. Lenders underwrite loan transactions using a calculation for student loan payments that can keep these highly trained professionals out of the housing market.

A “Doctor Loan” was designed to assist medical professionals in getting into a home with a low down payment while avoiding costly private mortgage insurance (PMI). They’ve been around for many years, but with the renewed focus on student loan debt, they’re making a bit of a comeback.

APM Elevate: February 2026

REACH YOUR GOALS

Five Reasons to File Your Taxes Sooner

There are two types of tax filers: those of us who file as soon as possible, and those who put it off until mid-April. If you're one of the millions who procrastinate, here are some reasons for filing early this year.

APM Financial Fitness: February 2026

As the months ahead take shape, many people are looking for ways to improve their cash flow, exploring options that range from checking their eligibility for a health savings account (HSA) to buying and selling through the growing recommerce market. While mortgage interest rates have fallen, creating new opportunities for home purchases and refinancing, some buyers are still choosing to wait for property prices to cool.

Pros and Cons of Buying vs. Renting

Buying vs. renting real estate will always be a personal decision—one that should be based on your lifestyle, goals, and financial well-being. Factors like interest rates, the housing market, and what others around you are doing can be influential, but the ultimate decision is up to you.

Putting all that aside, here are some pros and cons of buying vs. renting that you should consider when determining whether buying vs. renting is better for you.

APM Elevate: January 2026

REACH YOUR GOALS

Start 2026 with the Right Budgeting App

While there's no shortage of budgeting applications available, current user rates suggest that many consumers find it difficult to choose the right one. Recent studies found that while around 45% of consumers use spreadsheets and calculators, only around 21% use budgeting applications.

APM Financial Fitness: January 2026

As we step into a new year, it's a great time to reset, refocus, and look ahead with optimism. We hope the weeks ahead bring you and your loved ones good health, meaningful moments together, and plenty of reasons to feel hopeful about what's next.

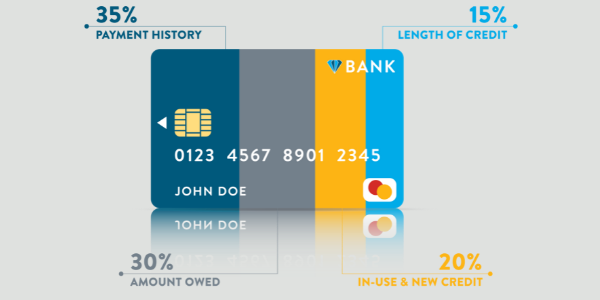

How Your Credit Score Is Calculated

You know credit scores are important, but you may be wondering how they are calculated and what the big deal is. This all-important number can be looked at for a multitude of reasons: when you get a job, lease an apartment, open a new account, or apply for a loan---including a home loan.

What Is a Good Credit Score to Get a Mortgage Loan?

Before you go shopping for a new home, you'll want to ensure that you meet the credit score requirements to secure a mortgage loan. And while many factors go into qualifying, a good credit score is definitely one of them.

We know that getting "rated" can make you feel like you're back in school. Like in school, however, with a bit of hard work, discipline, and dedication, you can improve your credit scores quickly!

So let's jump right in, starting with the obvious.

Can I Buy a Home with No Credit History?

It's true that credit is an important part of qualifying for a home loan, but it's not the end-all and be-all. Buying a home with no credit is possible---the process just takes a few extra steps. Those steps can depend on a few factors, including whether you have a cosigner, as well as the size of your down payment. They will also depend on what type of home loan you're pursuing.

APM Elevate: December 2025

The holiday season is here, bringing friends and family together to celebrate. Here's wishing you a festive season and a prosperous New Year.

APM Financial Fitness: December 2025

Rising costs continue to make news as we close out the year, with everything from insurance premiums to groceries putting pressure on household budgets. Some food costs have even spiked significantly compared to last year. The job market has shown mixed signals as well, with unemployment edging higher even as monthly job gains continue.

5 Holiday Home Staging Ideas

The holiday season is jam-packed with parties, shopping, cooking, gift-giving, and obligations. With all this going on, you might assume that the festive season is the worst time to buy or sell real estate.

Mortgage Review: Take Advantage of Improving Interest Rates

Mortgage rates have been a roller-coaster ride this year, leaving many homeowners wondering whether now is the right time to buy a home, refinance their existing mortgage, or simply stay put.

A quick mortgage review can help you uncover ways to save money, access cash, or position yourself for future financial goals, especially if you bought or refinanced in the past few years. Whether rates move up or down next, knowing where you stand puts you in control.

Budgeting for Homeownership in the New Year

There’s no better time than now to start preparing for homeownership. If your financial goals include things like saving for retirement, paying off student loan debt, or buying a home, this article provides some solid financial planning advice that will get you headed in the right direction.

As an additional resource, you can also download our personal budgeting guide here. When you have a solid plan and set a budget for homeownership, you may find that you’re able to buy a home more quickly than expected.

15 Ways to Make This Holiday Season Memorable Without Breaking Your Budget

The festive season is upon us! Unfortunately, it’s also the time of year when many of us find ourselves buried in credit card debt. While we all want to capture the perfect Instagram-worthy moments with family and friends, overspending can quickly dampen our holiday spirit.

12 Pet-Friendly Tips for a Safe, Festive Holiday Season

Our four-legged loved ones are always there to share in the merriment, and the holiday season is no exception. Unfortunately, their enthusiasm can sometimes lead to mischief and mayhem.

How to Set Achievable Financial Goals

New year, new goals, right? When it comes to personal finances and goal-setting, creating financial goals can be one of the most meaningful things you can do for yourself and your family.

TOP POSTS

Subscribe to our BlogSign up to stay up to date with the latest news, insights and more from American Pacific Mortgage!

RECENT POSTS