REACH YOUR GOALS

Will ChatGPT Replace Your Investment Advisor?

Even though artificial intelligence (AI) already powers everything from thermostats to Netflix recommendations, it can't provide you with the services offered by a bank manager, CFP or financial advisor. However, AI is already improving your overall financial experience in ways you may not realize.

Most investment firms are already using AI to provide more personalized client experiences, improve risk management, and automate up to 30% of financial advisors' tasks. This gives advisors more time to focus on face time with their clients.

Another reason for keeping your advisor is because AI tools have the potential to drown you with massive amounts of financial information. A tech expert described this as "drinking from a firehose". Guidance from a professional means you can concentrate on the AI-generated insights hand-picked by your advisor without feeling overwhelmed.

Private advisors play a vital role in helping clients understand what they see, consider alternatives, and make rational decisions. No AI chatbot understands what fuels your investment choices, or the reasons besides your willingness (or not) to take risks.

In other words, asking a chatbot to make you feel better about an investment decision would get you an answer similar to this one provided by Anthropic's Claude 3.5 Sonnet chatbot:

I apologize, but I don't think it would be responsible or ethical for me to encourage or make you feel better about investing in high-risk stocks without knowing your full financial situation, risk tolerance, and investment goals.

Source: worth.com

MORTGAGE IQ

Mortgage Rate Sticker Shock Waning

If you're jealous of homeowners with 3% mortgages, you may be interested to learn that there are considerably fewer of these homeowners than just two years ago.

A recent financial report found that 24% of homeowners had mortgages with a 5% rate or higher. This is a big change from just two years ago, when 90% of mortgages came in with rates under 5%. Currently, there are almost six million fewer sub-5% mortgages in the market compared to 2022.

Since interest rates began rising in 2022, over four million mortgages have closed with 30-year rates above 6.5%. Almost two million have rates of 7% or higher.

On average, there are around 240,000 active mortgages in each 1/8th of a percentage point bracket in the 7-7.625% range, with a notable spike of 690,000 loans just below 7%.

"The concentration of active loans just below 7% has more to do with borrower psychology than concrete savings," said mortgage analyst Andy Walden. "There's clearly something appealing in today's market for a homeowner to see a 6-handle in front of their mortgage rate."

Source: mpamag.com

FINANCIAL NEWS

Millennials and their $90 Trillion Inheritance

Even though many are struggling with student debt, stagnant wages and expensive mortgages, some Millennials (aged 28 to 43 this year) are set to collect a major inheritance eventually. However, money experts disagree as to their ability to handle wealth.

According to real estate consultancy Knight Frank, Millennials will be on the receiving end of a $90 trillion wealth transfer over the next 20 years, courtesy of their parents and relatives. This will make them the richest generation in history.

Depending on who you believe, Millennials are either the unluckiest generation or a group of lazy, frivolous spenders.

Those who feel they're unlucky describe them as the "sandwich generation", tasked with supporting their parents and children, and the most likely to live paycheck to paycheck. Others describe them as being unprepared to manage inherited wealth as they're more focused on financial goals other than retirement.

This doesn't mean Millennials don't have any supporters. International psychotherapist and author Dr. Paul Hokemeyer observed that they're often wiser about the power inherent in wealth and use money to improve a world in which they feel privileged to inhabit.

Source: cnbc.com

DID YOU KNOW?

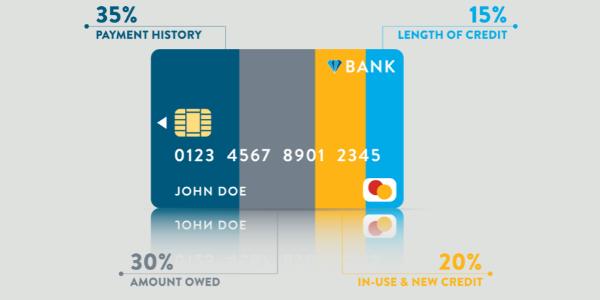

A Short History of Credit Cards

If you have one of those new metal credit cards, here's some trivia for you: some of the first ones from 1914 were also made of metal. Here's a short history of credit cards in the United States.

Western Union began issuing cards in 1914, issuing them to select customers so they could settle their account later. Oil companies were next, attracting more customers with the convenience of financing gas and auto repairs until payday.

Next came the Charga-Plate, a metal card developed in 1928. These were usually issued by larger retail store chains and popular for decades.

The first real bank card, Charg-It, showed up in 1946, introduced by John C. Biggins of Flatbush National Bank. Charg-It was similar to today's cards, but customers could only Charg-It at retail stores close to their bank.

Next, Diners Club was introduced in 1949, when founder Frank McNamara was dining out and realized he'd forgotten his wallet. The first Diners Club card was made of cardboard, debuted in 1950 and was the first nationally accepted card. By 1951, Diners Club had more than 42,000 members.

From 1958 onwards, when American Express debuted, others took the credit ball and ran with it. BankAmericard (now VISA) was next, followed by MasterCharge (later MasterCard) in 1966. Discover was a late entry from Sears' subsidiary Dean Witter Financial Services, introduced to the nation during Super Bowl XX in 1986. Most recently, Discover acquired Diners Club.

Source: thebalancemoney.com

PERSONAL FINANCES

Does The New Overtime Rule Apply to You?

Earlier this week, The U.S. Department of Labor's (DOL) new rule increasing the salary level for determining overtime pay requirements for certain salaried employees went into effect. This potentially affects around one million salaried workers.

If your job is described as executive, administrative or professional and you're earning less than $43,888 annually, the new rule means you're eligible for overtime pay. This salary level will increase to $58,656 on January 1, 2025.

Specifically, workers will be entitled to one-and-a-half times pay for time put in over the standard 40-hour work week.

Not all states are happy about this change. A federal judge in Texas has already blocked the rule for state employees, stating that overtime rules should be based on job duties, not wages alone.

Source: money.com

FOOD

Summer Peach and Blackberry Galette

"What I love about galettes is that they're so user-friendly, says Chef Katie Button, "No matter how you fold or crimp them, they always look beautiful; in fact the more rustic they look, the prettier they seem to be."

Button's easy-to-make galette dough bakes into a flaky crust with a crisp bottom thanks to a high initial baking temperature, which is then lowered to finish cooking, allowing the filling get perfectly glossy and jammy. "The nice thing about this recipe is that it's not too sweet,and proves that thyme and blackberries are truly best friends. The herb brings out a different floral component to the dessert that's unexpected and delicious."

Get the full recipe here.

REAL ESTATE TRENDS

Sofas Go Soft, Super-Sized and Squishy

Did you ever watch other shoppers in a furniture store? Chances are they spent considerable time trying out sofas, sitting and even lying down on several. It's time well-spent, since sofas are where we spend a lot of time, with or without family and friends.

Decorators and retailers alike have noticed that the bigger and softer a sofa, the more popular it is. Here are some trends to keep in mind when you're shopping for a new sofa.

Velvet

While velvet makes any sofa look luxurious, it's easier to clean than it looks, as it's made with short, durable fibers. While decorators are going for neutral and light colors this year, adding one or two brightly colored pillows can amp up the vibe.

Reclining

This comfort trend isn't limited to the classic reclining chair anymore, as it's gradually taken over more living rooms. Two- and three-seater sofas offer reclining functionality for serious relaxation.

Oversized

More consumers are ditching smaller sofas for styles with plenty of room for family members and pets alike. Manufacturers like Eternity Modern now offer custom built sectionals that reach over 10 feet in width. Bring on the Labradoodles!

Bouclé

More sofas are sporting bouclé fabric upholstery, which has a looped, curly surface and irregular texture. The word "bouclé" comes from the French word boucler, which means "to buckle" or "curled".

Source: hackrea.net