It’s an age-old question, at least when it comes to mortgage interest rates: Is it better to float your rate or lock in your mortgage? There are pros and cons to each, which can vary based on the overall economy, as well as unpredictable factors that can cause rates to go up or down.

Our Blog Puts YOU in the Driver’s Seat

Helping customers like you achieve their financial goals is all we do, which is why we’re arming you with our expert insight, tips, and advice to help you get there.

Mortgage Interest Rates: Float vs. Lock Strategies

APM Honors Women’s History Month

Foreword by CEO Bill Lowman:

As a CEO in the later stages of my career, my desire is to leave behind a legacy of inclusivity and equality, being part of much-needed and long-awaited change for our industry.

Factors That Influence Mortgage Interest Rates

There are a few really important numbers when it’s time to obtain a home loan: your credit score, the amount you want to borrow, and the interest rate. The news is full of talk about interest rates lately. Will they go up? Will they go down? Will they stay down? When they go up, how far will they go?

5 Benefits of Non-Conforming Loans

A non-conforming loan is any loan that doesn’t adhere to the Fannie Mae and Freddie Mac lending guidelines. These government-sponsored enterprises (GSEs) have certain rules that loans—referred to as “conforming loans”—have to meet regarding loan amount and credit score.

Construction Home Loans: Breaking Down the Loan Process

It’s easy to get tunnel vision when you’re building a new home and it’s nearing completion. You can practically feel that beautiful wooden banister and picture your shoe collection in that marvelous walk-in closet. These visions keep you going when your home is being built, but before you pack up those shoes, you want to make sure you understand the loan process, especially how your permanent loan finalizes.

What to Expect When Getting a Construction Home Loan

Building a new home can bring about a ton of questions—you may be mulling over everything from picking a builder and finding a location to deciding on the specific features you want. And that’s to say nothing of the home’s financing. Unlike an existing home with a permanent mortgage, building a home typically requires a home construction loan—at least during the construction phase. Thankfully, our construction lending team has you covered! We’ve streamlined the construction home loan process so you know exactly what you’ll be dealing with.

3 Ways to Get Creative when Paying Closing Costs

You finally found your dream home and are ready to start down that road to homeownership. It’s such an exciting time! … But then there are the fees. Underwriting fees, application fee, origination fees, recording fee, appraisal fee, and many others. Closing costs include so many fees that you may start to wonder if you’re really as ready to buy a home as you thought you were.

How to Get a Home Loan with No Credit

It’s true that credit can be an important part of qualifying for a home loan, but it’s not the end-all and be-all. There are buyers who get a home loan with little or no credit—the process just takes a few extra steps.

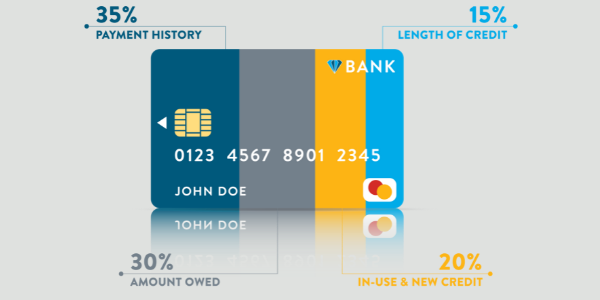

How Your Credit Score Is Calculated

You know credit scores are important, but you may be wondering how they are calculated and what the big deal is. This all-important number can be looked at for a multitude of reasons: when you get a job, lease an apartment, open a new account, or apply for a loan—including a home loan.

What to Do if Your Home is Burned or Destroyed by Wildfires

If you or your loved ones have been affected by a wildfire, our hearts go out to you. In this time of hardship and loss, we at American Pacific Mortgage send you our deepest sympathies and can only hope for a sense of calm and safety to be restored for you as soon as possible.

How to Set Effective New Year's Resolutions

The clock is ticking, but we still have a little time before 2022 is upon us. This year, no one could blame you for simply surviving the challenges that 2021 brought, but for those who want to thrive in the new year, setting a few effective resolutions can be your key to success.

APM Gives Back with Annual Employee Giving Challenge

“We must give more in order to get more. It is the generous giving of ourselves that produces the generous harvest.” ―Orison Swett Marden

’Tis the season! APM’s annual employee Giving Challenge is underway. From November 30 to December 21, APM departments and branches engage in a friendly battle for the top spot in generosity. Points are awarded for acts of giving, including donating to a food bank or toy drive, participating in a local charity run, sharing pictures and video of fun holiday traditions, or enrolling in our nonprofit entity, APMCares. It’s a fun way to kick off the holiday season and encourage employees to get active and do good in our local communities.

5 Ways to Use Your Home Equity

If you’ve owned a home over the past several years, chances are you have a great big smile on your face. That’s because you’ve probably watched your home’s value go up and up (and up). This is where all that scrimping, saving, and stressing over the homebuying process really pays off.

Understanding Home Equity

Equity. The word alone sounds promising, doesn’t it? It should. Equity equals value, and it’s a great strategy for building wealth.

But before you can put that equity to good use, you should first understand what home equity is.

APM Appetizers & Sides to Fill Your Holiday Table

The holidays are HERE! And what better way to celebrate than curled up with a few yummy dishes and the ones you love? Our APM family once again came through—sharing all their favorite holiday appetizers and sides with us.

Passing recipes down from generation to generation—or coming up with new recipes that beget new memories and traditions—is one of the best things about the holidays. Regardless of what holidays you celebrate, the food, love, and family and friend time are what it’s all about.

So we’re sharing a little food, love, and family with you, our extended APM family. We hope you enjoy the recipes—and the holiday season!

Deck the Halls with SAFE Online Holiday Shopping—Don’t Be a Victim!

Cyber Monday is one of the largest online shopping days of the year. Its popularity has grown as consumers have increasingly turned to online shopping, fueled by the COVID-19 pandemic. While Cyber Monday’s popularity has grown, so have the risks of shopping online.

The Benefits of Gratitude

Giving and showing thanks benefits more than just the recipient; it does great things for the giver as well. And this isn’t new-age mumbo jumbo. It’s backed by science.

Understanding When You Need a Jumbo Loan

Jumbo loans. Their name kind of hints at their function. The jumbo loan program is designed for loan amounts that exceed the conventional conforming loan limits of the Federal Housing Finance Agency (FHFA). In other words, they’re big loans. Some might even call them “jumbo.”

A large loan amount can mean something different to everyone—especially depending on where you live—which is why the FHFA carved out some guidelines on jumbo loans. Understanding them will be key to understanding when you need a jumbo loan.

TOP POSTS

Subscribe to our BlogSign up to stay up to date with the latest news, insights and more from American Pacific Mortgage!

RECENT POSTS